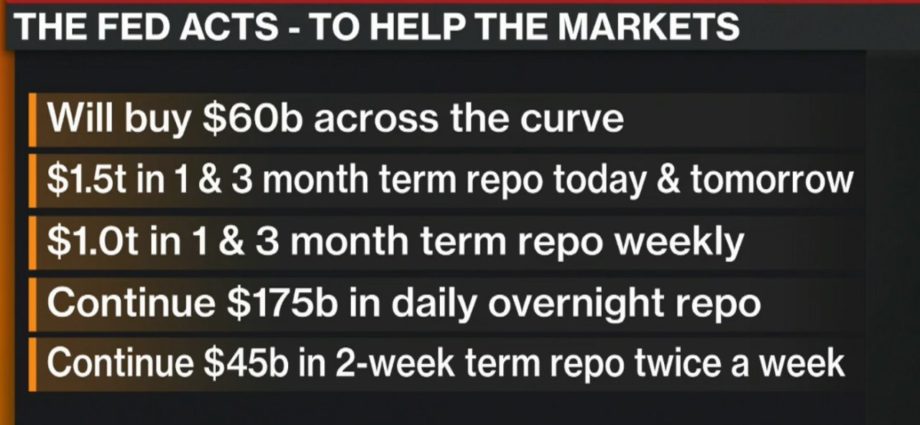

Yesterday was when Federal Reserve met to discuss monetary stimulus. After initially spiking, markets continued to slide; however, banks are flooded with liquidity which will have a positive impact on markets to help fight the ever-increasing fear and panic selling.

Equities rally as Germany pledges a debt package to contribute to global stimulus providers’ efforts. This is boosting markets as Germany is Europe’s largest economy.

Stocks are having a better day as a result.

In light of more calm in the markets today, gold has resumed its ability to perform its safe-haven duties as opposed to being the victim of a sell every asset mentality including good assets to help pay for the losses and margin calls of more poorly-performing assets.

U.S. futures surge +5.00% and hit a limit-up level to halt trading.

German Finance ministers: We can’t rule out government taking stakes in firms.

ECB yesterday added $120 billion in net asset purchases but no rate cut.

How much will Federal Reserve cut interest rates on March 18th after having already cut -0.50% in an emergency announcement when no meeting was scheduled. Last time they did that was during the Global Financial Crisis of ’08. It doesn’t make sense to cut half a percent instead of waiting two more weeks to the next regularly scheduled meeting and then not cut at all at that meeting also. Question is how much.

-0.25%

-0.50%

-0.75%

BREAKING NEWS: EU Commission expects EU GDP to shrink by around 1% in 2020