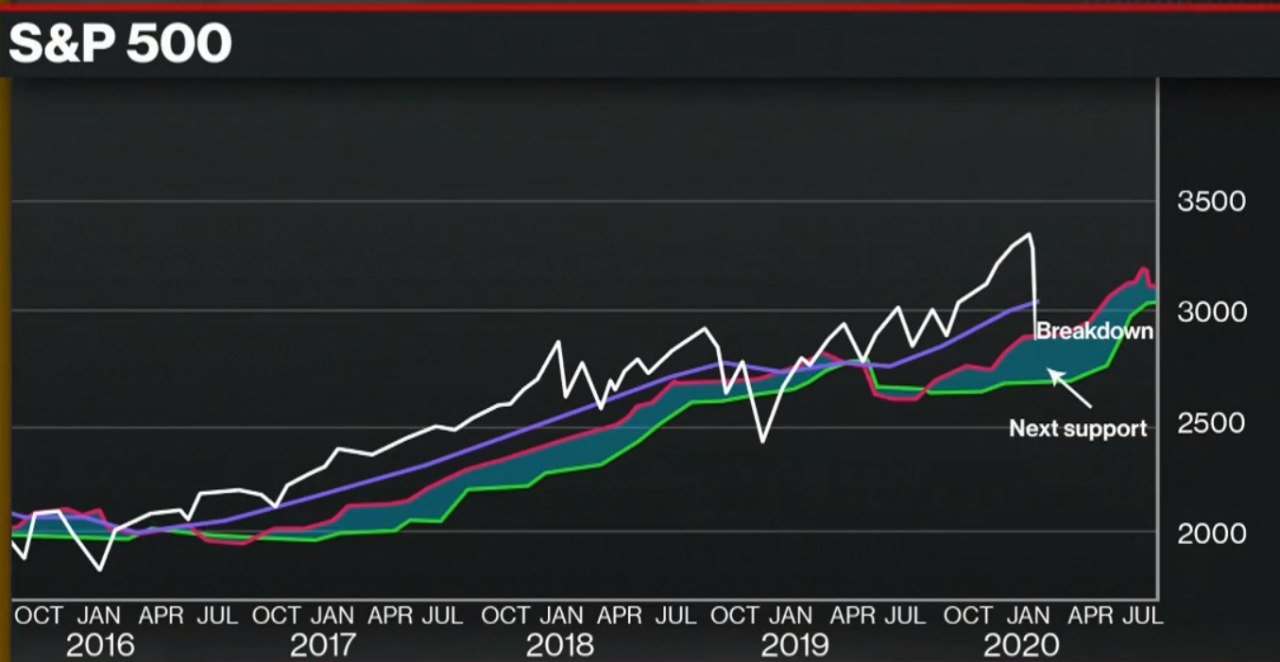

Markets continued its free fall despite a few days of dead cat bounces.

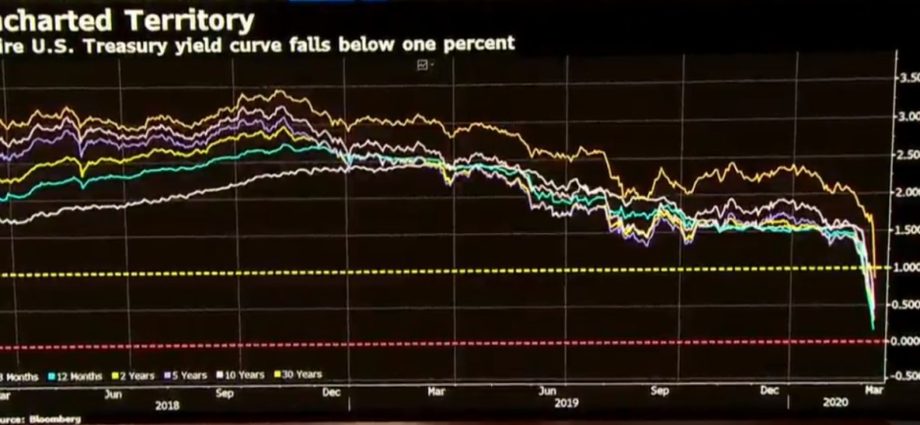

The ENTIRE U.S. yield spectrum for every length of time is now currently below 1%. Last year, I had been calling for U.S. yields to fall to zero percent since many nations around the world are already negative to the tune of $17 Trillion last year, then just $13 trillion, but this figure has risen again.

Germany’s yield just crossed below MINUS 1% today for the first time!

Trading is currently halted for S&P500 futures after falling -5% in pre-market trading.

This is neither 2014 (for oil) nor 2008 (for equities). This is much worse and is going to get a lot more ugly.

Impact of lower oil prices on countries

As countries begin to suffer from lower oil revenues, it could trigger protests and riots in the streets. If that doesn’t cause unrest, sovereign nations defaulting on their debt will when the IMF demands austerity measures. By the way, Lebanon just this weekend announced that they WILL default on their debt. Will other nations now find it easier to follow suit?

WTI Crude Oil holding near $32.10 which is near the -30% level for the 2-day drop and -22% intraday.

Diamondback cuts 2 drilling rigs for next month already. Which energy producers will survive and which ones will get bought out? No free cash-flow at these oil prices.

Lower interest rates pains for EU and US banks

Banks can’t make money by charging lower rates. This is really hurting the financial sector today, an industry I’ve been waiting to watch fall harder than others when the next meltdown I spoke of would commence (which we are presently in).

German 10-year yield:

-0.85% (negative)

With the entire US Treasury Curve below 1% I’m expecting the Federal Reserve to cut interest rates at their March meeting (17-18th) in addtion to the -0.50% cut they recently did during an emergency annoucement (the first inter-meeting cut since the Financial Crisis of 2008).

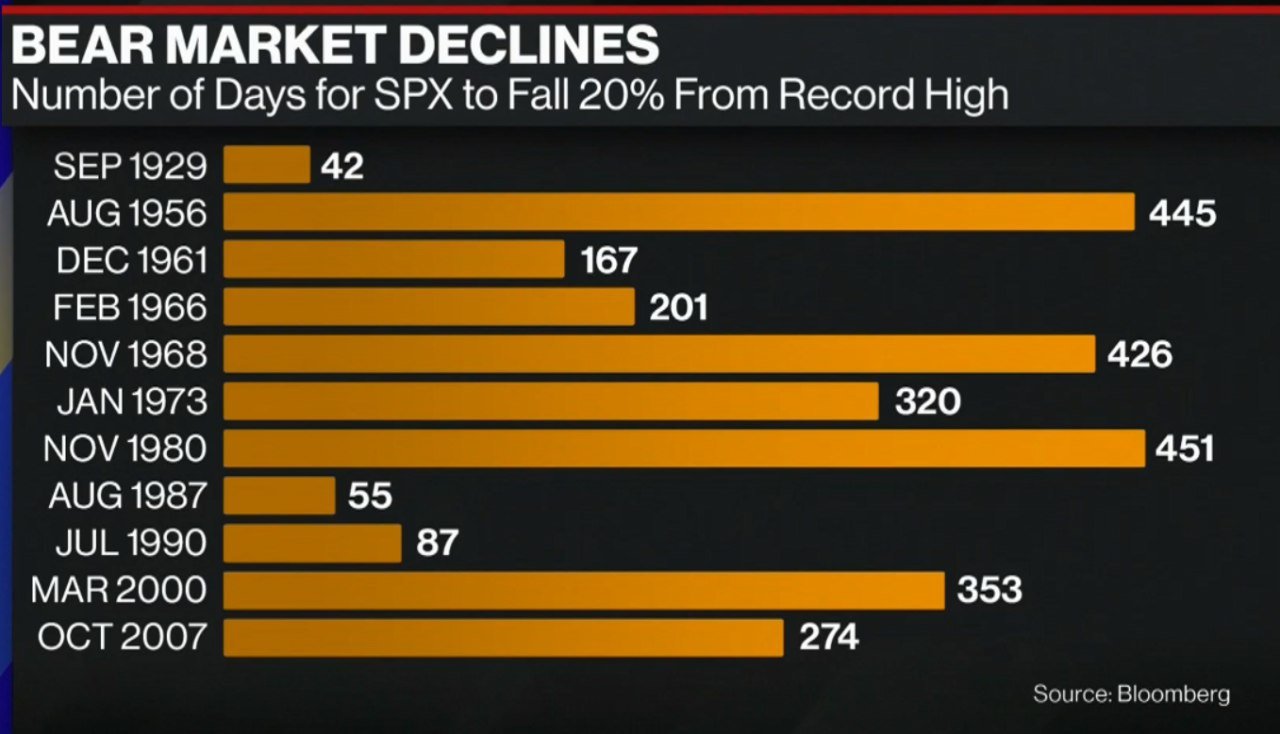

Black Monday of 2020?

This will come to be known as Black Monday of the Greater Depression

VIX Index hit its highest level since 2008. Throughout all of 2019 I mentioned VIX being way to low in at least half my videos.

Trump being presented with Economic package today when he lands at White House in helicopter. Among the measures will likely be paid sick leave to help fight Coronavirus.