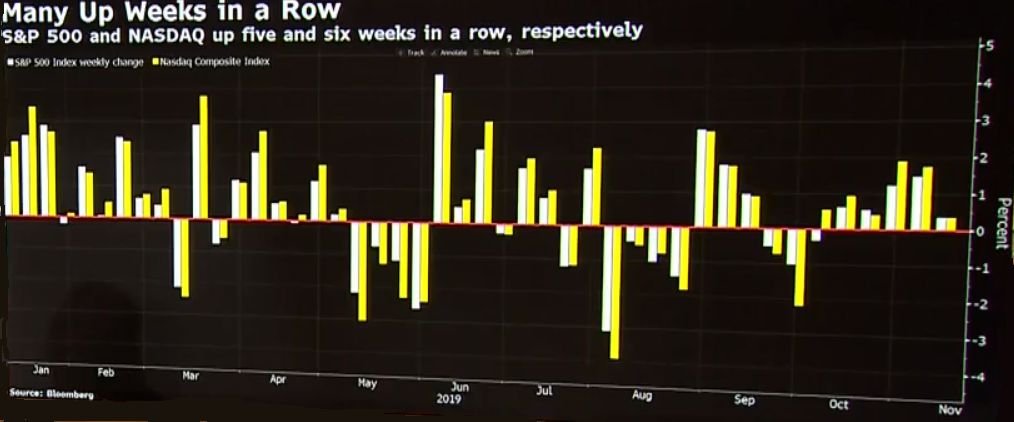

Wall street indices had another up week with S&P500 finishing in the green for it’s 5th week in a row (longest streak since March)

…And Nasdaq ended higher for 6th week in a row (Longest streak since May).

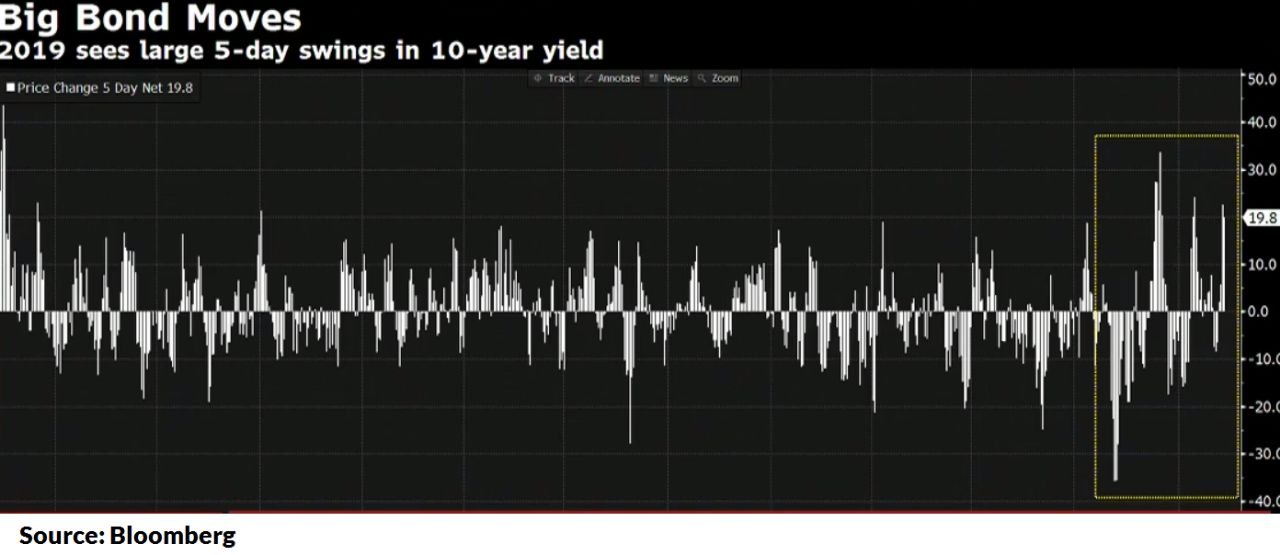

While many are ecstatic about Wall Street in record territory, few are keeping in mind the bond yield inversion that happened a few weeks ago.

If you are wondering why I’m watching Bond yields more than previous years:

1) yields affect bank profits.

2) inverted yield curve precedes recession.

3) we are seeing wild swings recently (chart above) impacting demand for risk-on or risk-off assets (as well as currencies and commodities).

4) over a quarter of debt is negative already globally, a sign we may see a cashless society very soon.

What to expect for next week

Tuesday, Trump speaks on trade at the Economic Club of New York.

This will be the biggest news impacting investor sentiment over the course of the next week.

Whether he makes a positive announcement or not will play a big difference on all sectors and assets.

Trump said that the U.S. hasn’t agreed with a tariff rollback with China (A key condition by China for a phase 1 deal).