Written by Robert Kovacs

Introduction

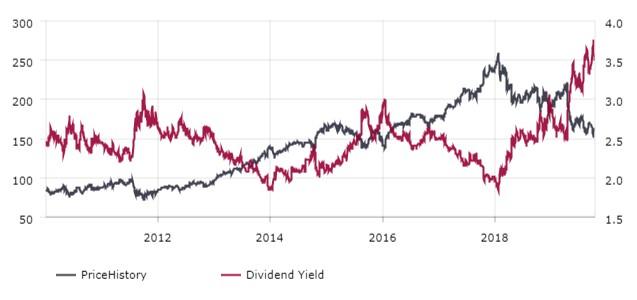

In March 2018, I published a piece explaining why investors should stay away from 3M (MMM). The stock yielded 2% which made its dividend potential below my expectations. Since then, the stock price has declined 30%. 3M Company is currently trading at $162.98 and yields 3.53%.

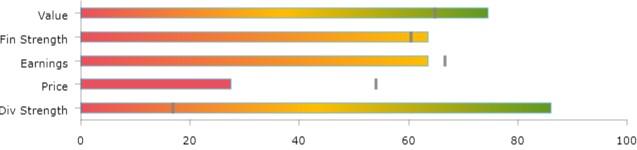

In my previous article I claimed that 3M would be an interesting stock for dividend investors if it yielded at least 3%. My M.A.D. Assessment gives MMM a Dividend Strength score of 86 and a Stock Strength score of 64.

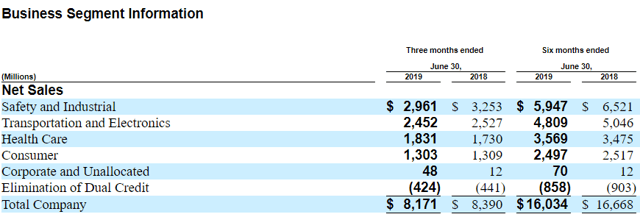

Source: 3M

Yet, given the current late stage of the business cycle, and the fact that 3M’s revenues have declined sequentially for the past 4 quarters and that industrials usually outperform badly in recessions, I’m in no rush whatsoever to buy any shares.

The yield is unusually high for this company, yet 3M’s dividend yield went as high as 4% during the last recession. Given the stock’s awful relative performance over the past year, I wouldn’t be surprised to see the stock go lower in upcoming quarters.

Source: mad-dividends.com

3M is a well-known company, which manufactures industrial, safety and consumer products. It operates through the following five segments: Industrial, Safety & Graphics, Health Care, Electronics & Energy, and Consumer.

My article will first consider 3M as a dividend investment before considering its potential for capital appreciation.

Dividend Strength

For me a strong dividend stock is both a safe dividend stock and a stock with good dividend potential. Dividend potential is defined by the combination of the dividend yield and dividend growth. The last time I analyzed 3M, I discarded the investment because of the low dividend yield. At the time the stock yielded just above 2%. Even if the company were able to continue growing its dividend at 10% per annum, I wasn’t interested. Let’s see what’s changed this time around.

Dividend Safety

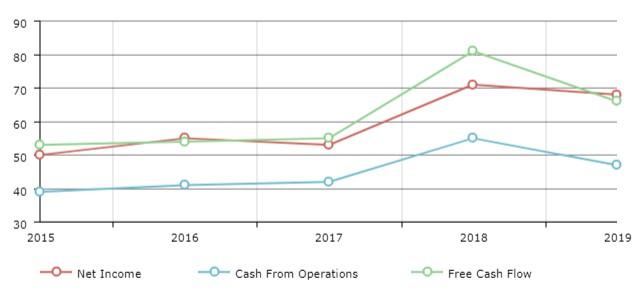

3M Company has an earnings payout ratio of 68%. This makes MMM’s payout ratio better than 26% of dividend stocks.

MMM pays 46% of its operating cash flow as a dividend, which is better than 25% of dividend stocks.

MMM pays 66% of its free cash flow as a dividend, which is better than 35% of dividend stocks.

|

30/06/2015 |

30/06/2016 |

30/06/2017 |

30/06/2018 |

30/06/2019 |

|

|

Dividends |

$3.7800 |

$4.2800 |

$4.5800 |

$5.0800 |

$5.6000 |

|

Net Income |

$7.66 |

$7.84 |

$8.77 |

$7.24 |

$8.27 |

|

Payout Ratio |

50% |

55% |

53% |

71% |

68% |

|

Cash From Operations |

$9.81 |

$10.54 |

$11.01 |

$9.35 |

$12.12 |

|

Payout Ratio |

39% |

41% |

42% |

55% |

47% |

|

Free Cash Flow |

$7.25 |

$7.95 |

$8.42 |

$6.29 |

$8.51 |

|

Payout Ratio |

53% |

54% |

55% |

81% |

66% |

Source: mad-dividends.com

During the past 5 years, 3M’s earnings and cash flows have been erratic, showing no clear patterns of growth. In the meantime, the dividend has increased by more than 60%, making the payout ratios significantly higher. While this hasn’t put 3M’s dividend at risk, it might challenge future dividend growth if the company is unable to generate more cash flow.

A positive is that MMM has an interest coverage ratio of 17x which is better than 84% of stocks. This level of coverage attests of the company’s strong financial strength, and puts any risks concerning leverage at bay.

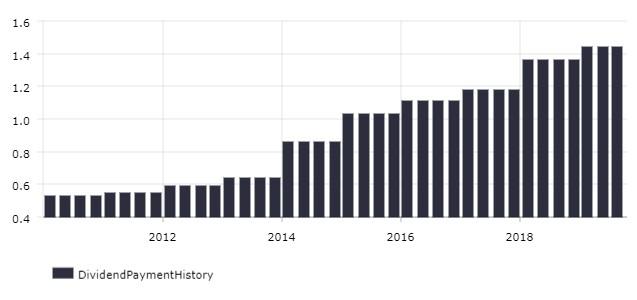

Furthermore, 3M has been increasing its dividend for 61 years. As long as this company can pay a dividend it will, and for now there is nothing which is threatening the viability of the dividend.

Without a doubt, even amid a softening environment, MMM’s dividend remains safe.

Dividend Potential

3M Company has a dividend yield of 3.53% which is better than 70% of dividend stocks. The stock’s dividend yield hasn’t been this high since the last recession.

Source: mad-dividends.com

The dividend grew 5.8% during the last 12 months, which is somewhat lower than the company’s 5-year average dividend growth of 11%.

Source: mad-dividends.com

As revenues continue to soften in upcoming quarters and payout ratios remain high, we might wonder whether the rapid growth we’ve witnessed in the last decade isn’t just about to slow down.

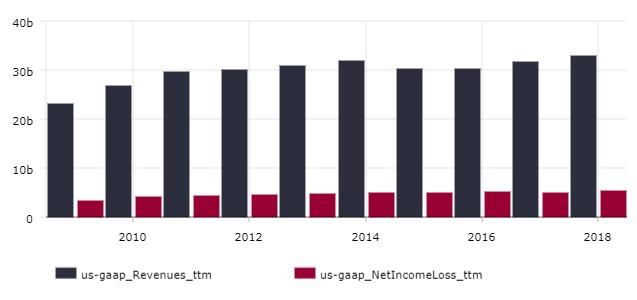

During the last 3 years, the company’s revenues have grown at a 2% CAGR, while net income has grown at a 0% CAGR.

Source: mad-dividends.com

As I mentioned in the introduction, revenues have been declining sequentially for the 4 past quarters.

Growth has stalled in all segments but Healthcare. Year over year, the Safety and Industrial segment is down 9%. Transportation and electronics is down 4%. Healthcare is up 3% while Consumer is flat.

The decline in the industrial segment comes from a tough environment across the entirety of the company’s portfolio. The auto aftermarket, as well as abrasives, adhesives and the masking/closure business suffered from inventory reductions throughout the channel which reduced demand significantly. This is expected to continue for the second half of the year, as can be shown by management’s lowered expectations for the segment, especially in China. While the company had previously expected a flat year, they now see revenues down in the low to mid-single-digits.

Similar trends are happening in the electronics business. All along the channel, 3M’s customers are destocking, which is pushing demand for 3M’s products lower.

For this very reason, 3M is an interesting stock to analyze. Since it serves many of the heavy industrials, its revenues can serve as a leading indicator of expected demand in the industrial and automotive sector. It would seem, however, that for the rest of the year, revenues should be down.

By how much? Sales will likely decline 3-5% YoY for the third quarter and be flat to slightly declining in the fourth quarter if we believe Wall Street’s estimates.

Surely, at this point you’re wondering why I would suddenly decide to give these estimates any weight. As you might know, I’ve never cared much for Wall Street forecasts. I do, however, pay a lot of attention to management’s forecasts, as they see the business’ operations play out daily. And in the latest earnings call, Nick Gangestad, the company’s CFO, said:

if I think about where we are going to end for the full year, let me just start out by saying when I look at collectively where all the sell-side analysts are in their view of the total year. My view is it looks like you collectively have it dialed in about right. What I’m seeing collectively amongst all of you means it lines up very closely with our own internal view of how things will progress for the full year.

So if the CFO thinks Wall Street is correct, maybe I’ll give them the benefit of the doubt. This is happening on the back of softening world economies. Investors should expect the destocking which is happening in automotive in China to continue into the 3rd quarter before stabilizing in the 4th quarter, provided that the world economy doesn’t degrade.

The only strong market right now for MMM is healthcare, which is up 3.5% organically. The integration of Acelity will add to MMM’s portfolio of medical devices. Unfortunately, while success in this segment is appreciated, the company isn’t exposed to enough growing segments for it to really make a difference when its industrial & electronics business is suffering.

While cyclicality is expected with industrial stocks, I believe it is an early indication of a few years of slower dividend growth for 3M. Given that the dividend already represents about two-thirds of both earnings and free cash flow, I doubt that management will venture into increases of more than 5% for the next few years.

Dividend Summary

MMM has a dividend strength score of 86/100. This stock’s dividend history is fantastic, and I am sure that the company will continue to increase its dividend for a long time. However, I am not convinced that the rate of increase will remain 10% forever. The business is simply unable to generate sufficient growth to support such a high rate of growth. Therefore, I expect forward dividend growth to be around the 5% mark. A 3.5% yield is borderline suitable for such dividend growth prospects, but as we’ll see in the next section, I believe more downside is in store for 3M. Dividend investors might want to wait, and see if they can snag the shares at yields closer to 4%.

Stock Strength

Industrials have fooled more than one investor. They tend to look good at the top of the cycle, and bad at the bottom of the cycle, making timely investing more artful than other businesses. For instance, during the past 12 months, the median industrial stock has had similar momentum to the median US stock, yet it is markedly more undervalued based on multiples. During the past 3 years, the median industrial stock’s revenues increased by 4.48%, while the median US stock’s revenues increased by only 2.3%. The US is markedly in the late stages of the business cycle, as indicated by decelerating earnings growth and the inverted yield curve. Industrials have historically underperformed in recessions, so investors should be wary of buying industrials amid the current environment.

Still let’s look at four fundamental factors – value, momentum, financial strength and earnings quality – for MMM to determine the likelihood of capital appreciation.

Value

- MMM has a P/E of 19.71x

- P/S of 2.97x

- P/CFO of 13.44x

- Dividend yield of 3.53%

- Buyback yield of 3.00%

- Shareholder yield of 6.53%.

According to these values, MMM is more undervalued than 75% of stocks, which would suggest that the stock is quite cheap. But its value is mostly derived from its shareholder yield, which is better than 89% of stocks. Based on multiples of earnings, sales and cash flows, 3M would seem more undervalued than only 40-50% of US stocks.

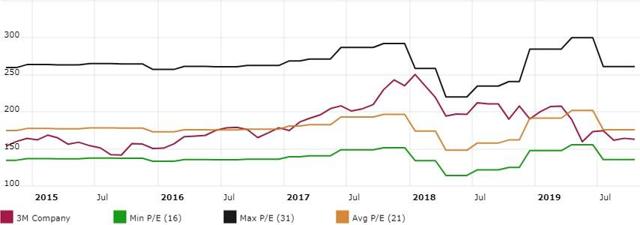

Source: mad-dividends.com

MMM is trading just shy of 20x earnings. I wouldn’t say this is cheap, since just in the past 5 years the company has traded as low as 16x earnings. If we use 16x as the lower multiple for 3M’s earnings, the stock’s downside could be as much as 20%.

3M doesn’t look expensive. Certainly not as expensive as it was the last time I assessed it in March 2018, when it traded at 29x earnings. Yet it doesn’t quite look like it is in bargain territory yet. The buybacks supplement the dividend nicely, but not enough to make the 3.5% yield look like a bargain.

Value Score: 75/100

Momentum

3M Company trades at $162.98 and is down -5.70% these last 3 months, -24.49% these last 6 months and -18.08% these last 12 months.

Source: mad-dividends.com

This gives it better momentum than 28% of stocks, which is very worrying. Both the stocks 6- and 12-month performance are appalling. I expect this negative momentum to continue as more softness in results in upcoming quarters will undoubtedly shoot the stock lower still.

Momentum score: 28/100

Financial Strength

MMM has a gearing ratio of 2.9, which is better than 29% of stocks. The company’s liabilities have increased by 9% over the course of the last 12 months. The company’s operating cash flow can cover 24.7% of liabilities. As mentioned above, the stock also has fantastic interest coverage. This makes MMM more financially sound than 66% of U.S. listed stocks. Its Cash flow/Liabilities ratio is among the top 25% of US stocks. The company generates boat loads of cash. While it has increased its long-term debt quite significantly during the last 12 months, MMM remains a financially superior firm.

Financial Strength Score: 66/100

Earnings Quality

MMM has a Total Accruals to Assets ratio of -10.6%, which is better than 59% of companies. It depreciates 85.9% of its capital expenditure each year, which is better than 37% of stocks. Finally, each dollar of assets generates $0.8 in revenue, which is better than 67% of stocks. This makes MMM’s earnings quality better than 64% of stocks. An efficient asset base, a high amount of negative accruals, and a reasonable rate of depreciation make MMM a well-rounded company.

Earnings Quality Score: 64/100

Stock Strength Summary

When combining the different factors of the stock’s profile, we get a stock strength score of 64/100. The upside is that MMM offers an interesting shareholder yield at current prices and has solid fundamentals. The downside is that from here on, the sector has very few tailwinds, the stock has negative momentum and could decline an extra 20%.

Conclusion

While buying MMM with a 3.5% yield wouldn’t necessarily be bad, loading up on industrials in the late stages of the business cycle is not advisable.

With a dividend strength score of 86 and a stock strength of 64, 3M Company is a company which dividend investors should watch as I expect a more attractive point of entry will appear in the future.

If you enjoyed my analysis, hit the orange “Follow” button at the top of the article to receive free notifications when we next publish an article on interesting dividend-paying stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.