Dividend growth investing is a popular and largely successful approach to generating wealth over long periods of time. Investors typically do well focusing on companies with long streaks of dividend increases, in part because of the positive qualities a business needs in order to be able to continually afford what is ultimately a cash layout to shareholders. However, many of the companies known as “Dividend Champions” – those with 25 consecutive years (or more) of dividend growth – are mature companies. By identifying strong companies earlier in their life cycle, we can benefit from strong total returns while these companies build their dividend growth reputation. We will be spotlighting numerous dividend up and comers to identify the best “dividend growth stocks of tomorrow.”

Overview

Amgen Inc. (AMGN) is a pharmaceutical company that researches, develops, and brings to market a number of specialty drugs worldwide. The drugs developed by the company are primarily geared towards the hematology, oncology, cardiovascular, inflammation, neurological, and bone health areas of medicine.

(Source: Amgen Inc.)

The pharmaceutical industry is a game of innovation. When companies successfully develop and bring to market a new drug, it is patent-protected for a number of years. The cost of R&D and developing drugs is high (because of the high failure rate – the hits have to make up for all of the other misses), but patent-protected “blockbuster” products can provide many years of strong cash flow. Amgen is one of the largest players in its field, which also gives it a financial advantage in that the company can absorb more “misses” in an effort to find its next blockbuster product. Eventually, these patents expire, which is when generic alternatives come to market and eat into sales of the name brand product.

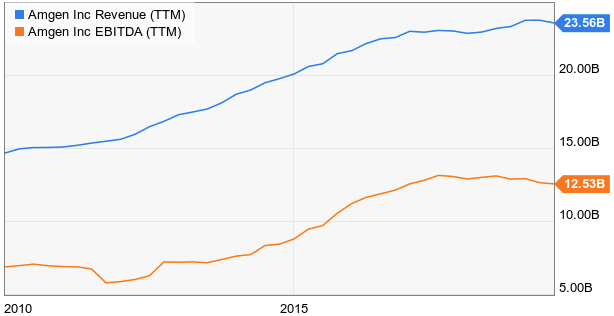

(Source: YCharts)

Over the past decade, Amgen’s revenues have grown at a CAGR of 4.70%, while EPS has grown at a 12.46% rate. The company generates more than $23 billion in annual sales.

Fundamentals

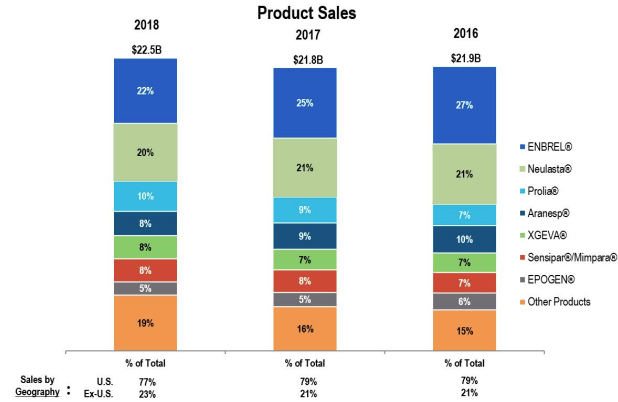

A company such as Amgen has a number of blockbuster drugs at any given time that pump the company full of cash. The company’s top two drugs, Enbrel and Neulasta, combine to contribute 42% of revenues. However, as an example from above, sales of Neulasta in 2019 are down 25% year over year. The drug’s patent protection expired, and competition has moved in. This type of sudden loss of revenue can create volatility in the business. That is why long-term consistency is such a good indicator of strong performance in this sector. To illustrate Amgen’s performance, we will look at a few key operating metrics over a 10-year period.

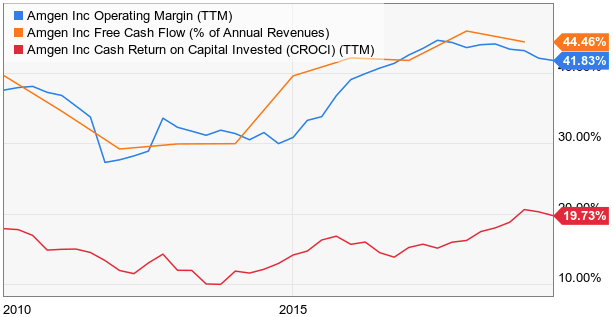

We review operating margins to make sure Amgen is consistently profitable. We also want to invest in companies with strong cash flow streams, so we look at the conversion rate of revenue to free cash flow. Lastly, we want to see that management is effectively deploying the company’s financial resources, so we review the cash rate of return on invested capital (CROCI). We will do all of these using three benchmarks:

- Operating Margin – Consistent/expanding margins over time

- FCF Conversion – Convert at least 10% of sales into FCF

- CROCI – Generate at least 11-12% rate of return on invested capital

(Source: YCharts)

While there has been some volatility in Amgen’s metrics over time, the business as a whole has performed above our benchmarks for the entirety of the decade. What’s more is that all of the metrics have improved over the past three years. The company has been a certified “cash cow,” turning more than 44 cents of each dollar into free cash flow.

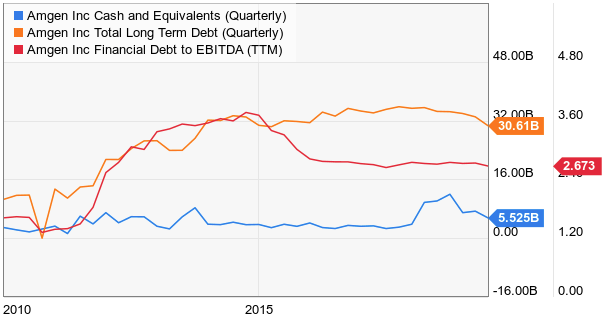

Despite generating so much cash, Amgen has leaned quite heavily on its balance sheet. The company maintains a solid cash hoard at $5.52 billion (a debt to cash ratio of 5.5X), but leverage is a little high at 2.67X EBITDA. This is just above our cautionary benchmark of 2.5X EBITDA. What’s worse is that Amgen has a huge acquisition looming in the form of its $13.4 billion deal to acquire the rights to Otezla from Celgene (CELG) that will close near the end of the year (more on that later). This will certainly add to the company’s leverage figures.

(Source: YCharts)

So, where does Amgen spend all of its cash? It did generate more than $9 billion in free cash flow last year. As we will discuss further down, the company spends heavily on both M&A and on putting cash in the pockets of its shareholders.

Dividends and Buybacks

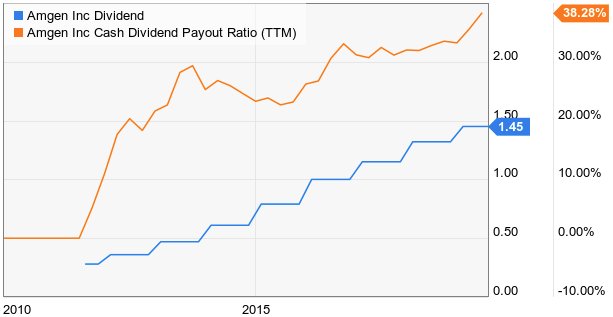

Amgen has been growing its payout since initiating its dividend in 2011. That means its current dividend growth streak of nine years with a raise has begun to put the company on the radar of dividend growth investors. The dividend totals an annual sum of $5.80 per share, which results in a yield of 2.85%. This is a solid yield for investors looking for income or to reinvest the dividends. For comparison purposes, the current yield on 10-year US treasuries is 1.74%.

(Source: YCharts)

The dividend has grown at a solid rate as well over that time frame. Over the past five years, a CAGR of 22.9% has easily outpaced inflation. This type of pace is not sustainable, as the company’s cash payout ratio has risen to 38%. The dividend is obviously well-covered, and there is certainly room to continue dividend growth. However, Amgen’s cash flow is needed in a few other important areas, so the need for financial flexibility will likely slow that dividend down to a high-single digit growth rate in the future.

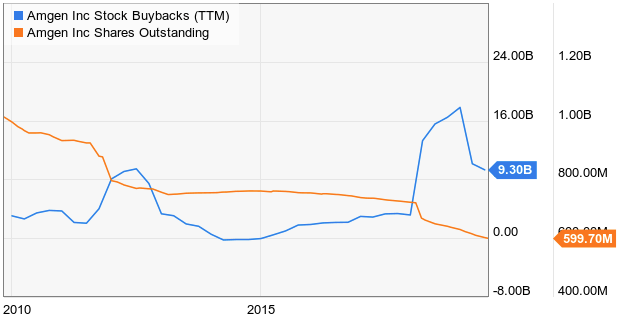

One such area that Amgen spends on is buybacks. Buybacks not only benefit shareholders by making their shares more valuable in a smaller float, but they reduce the total cash outlay for the dividend as well.

(Source: YCharts)

Amgen’s spend on buybacks has been uneven over the years, but over the past decade the float has dropped about 40%, from 1 billion shares to just under 600 million.

Growth Opportunities and Risks

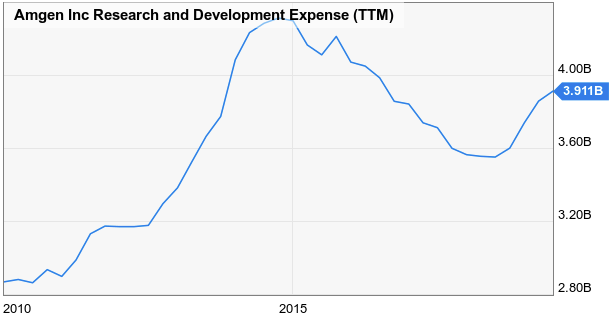

The third area of need involves injecting cash back into the business for growth. While some companies (a tobacco company, for example) can repeatedly give its cash to investors, a pharmaceutical company’s need for continued innovation requires a constant stream of cash flow available to fund it.

These growth efforts could come in the form of research & development to bring new drugs to market from in-house development efforts. As we noted earlier, pharmaceutical companies spend billions of dollars each year developing new products. Amgen is no exception here, with average R&D expenses ranging between $3 and $4 billion per year.

(Source: YCharts)

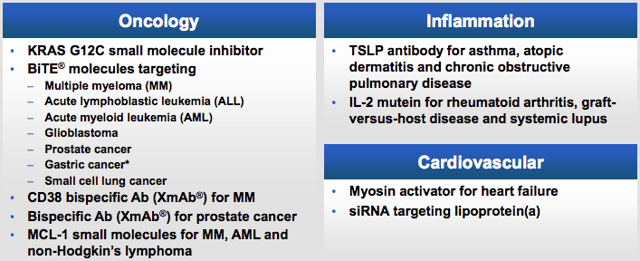

This money has funded the development of a number of prospects in Amgen’s pipeline. Many of these potential products are aimed at some of the highest spend areas of human healthcare, such as oncology and cardiovascular health.

(Source: Amgen Inc.)

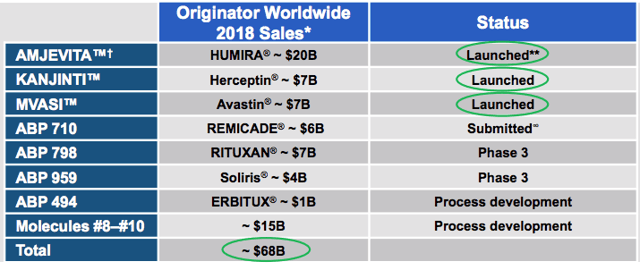

In addition, the company is developing biosimilar products (essentially generic alternatives) to some of the largest blockbuster products sold by competing pharmaceutical companies.

(Source: Amgen Inc.)

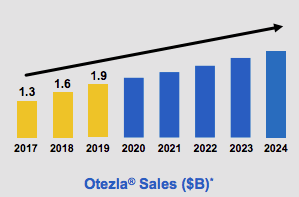

The company can also bring in external growth through M&A activity. As already mentioned, Amgen is in the process of closing on a $13.4 billion cash deal to purchase the rights to Otezla from Celgene. Otezla is a drug that treats inflammatory diseases such as psoriasis and psoriatic arthritis. 2019 sales are projected at $1.9 billion, which would represent about 8% of Amgen’s total 2018 revenues. However, that should escalate, as the company projects average growth for Otezla in the low double digits over the next five years. This will make Otezla a likely future top three producer for Amgen.

(Source: Amgen Inc.)

It will take some time for Amgen to heal its balance sheet following a large deal such as this, but this isn’t the first (or last) acquisition that investors will witness by the company. Pharmaceutical companies with Amgen’s scale and cash flow will continually make strategic deals to bring growth into their portfolio.

While the pharmaceutical industry has been somewhat of a juggernaut for many years, there is a large sector threat on the horizon. The United States has seen a slow shifting political movement that has shone a light on the expensive cost of drugs and healthcare in the US. Although the US senate remains Republican-controlled, uncertainty regarding healthcare/drug price reform could increase should the political landscape change in 2020. Amgen generates a whopping 77% of its revenue in the United States.

Valuation

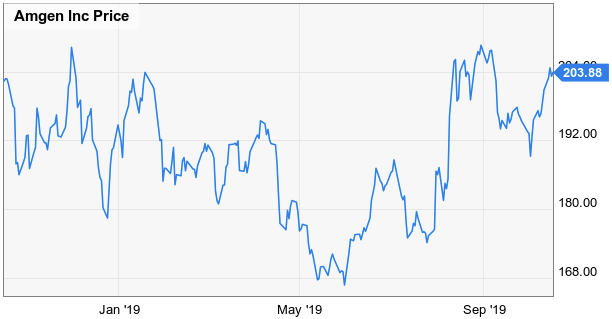

Shares of Amgen currently trade at the top of their 52-week range ($166-211) at just under $204 per share.

(Source: YCharts)

Based on analyst estimates that the company will earn $14.36 per share for the current fiscal year, the stock currently trades at a 14.20X earnings multiple. This is a slight discount of 10% to the stock’s 10-year median P/E ratio of 15.87X.

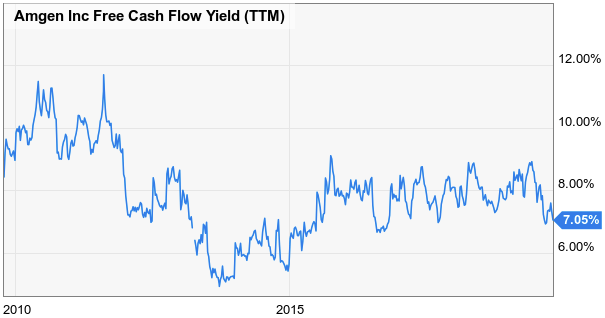

If we look at valuation from a cash flow perspective, we see slightly less value. The stock’s FCF yield of 7.05% is solid but at about the midpoint of post-recession levels.

(Source: YCharts)

Shares appear fairly valued – maybe slightly undervalued against historical norms. The addition of Otezla will be immediately accretive to earnings, so that needs to be considered. We like Amgen at these levels for long-term investors, but we wouldn’t be surprised to see some increasing volatility around US healthcare create some better buying opportunities as the political focus increases around next year’s election.

Wrapping Up

In all, Amgen is a very strong company. The balance sheet will be bloated following the closure of the Otezla deal. Meanwhile, US healthcare reform could significantly impact companies such as Amgen – although we are still far from that becoming a reality. Aside from those cautionary notes, the company is a leader in a lucrative field. It generates immense cash flow streams, and the addition of Otezla should help push growth forward. Amgen is one of our higher-rated pure pharma companies.

If you enjoyed this article and wish to receive updates on our latest research, click “Follow” next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.