Ally beat Q3 forecasts, breaking the $1.00 quarterly EPS barrier

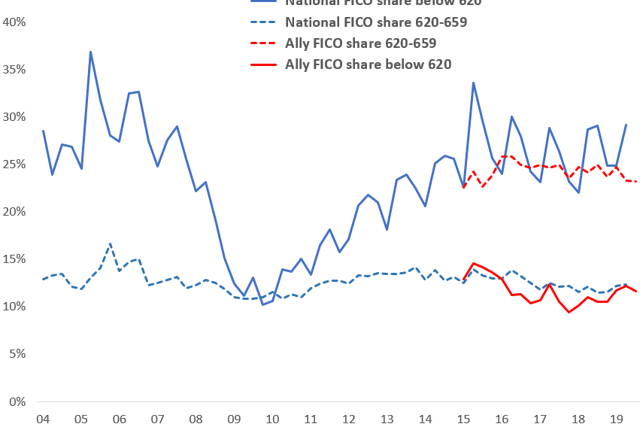

Ally (ALLY) reported operating EPS of $1.01, beating the Street’s $0.98 estimate. The $4.04 in annualized EPS is nearly double its 2016 EPS of $2.16. How has Ally made such impressive progress? To see how, I compared Ally’s Q3 summary income statement and return on assets to Q4 2016:

Source: Ally financial statements

Key earnings drivers have been:

Earning assets grew by 15%, or 4.7% annualized. Solid, but not flashy. Flashy lending growth usually ends in a car wreck, so Ally gets a checkmark here.

The interest margin expanded by 12 bp, driven by both good auto loan pricing and the strong growth in retail deposits.

The loan loss provision is lower, due to good lending standards and a strong job market.

The tax rate fell to 24% from 36%, due of course to the 2017 tax cuts.

Share repurchases cut the share count by 18%, turning a 54% earnings gain into an 87% EPS gain.

Pretty awesome all around. But stock prices don’t look back, they look forward. What are Ally’s prospects?

Loan quality weakened a bit, but Ally is well-positioned to weather a weaker job market

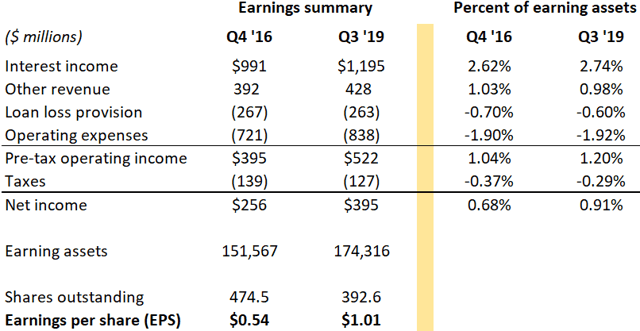

Ally’s pathetic 7.2 P/E, well below even the low bar of other financial stocks (political punching bag Wells Fargo (NYSE:WFC) is at 11.4), can only be explained by its focus on auto lending. Car loans are 47% of Ally’s earning assets, and loans to auto dealers are another 19%. The fact that Ally’s Q3 car loan charge-off rate of 1.38% was up 6 bp from a year ago could therefore be concerning, especially when many see a looming recession. In fact, the U.S. job engine does seem to be sputtering, as this data on job openings and job growth shows:

Source: U.S. Department of Labor

The chart shows that job openings, a reasonable leading indicator of job growth, appear to have rolled over. So is a large spike in Ally’s car loan charge-offs around the corner, with dire earnings consequences? For example, if Ally’s loan loss provision doubled, its EPS would be cut in half.

But don’t despair, dear reader. The health of the job market is less important to loan defaults than is loan underwriting standards. And there is plenty of evidence that auto lending standards are respectable, and have been so for the past decade:

- A critical sign of poor lending standards is too-rapid loan growth. Otherwise, why take the risk? Ally’s car loans grew by a moderate 4.4% over the past year, and 4.8% over the past four years. National auto debt grew slightly more slowly. The debt growth was right in line with the 4.5% household income growth of the past four years. So both Ally and its competitors have been rational.

- Another sign of too-aggressive lending is excessive price competition. But Ally’s loan yields have held steady at around 7.5% for the past six quarters, and it sees few signs of irrational pricing.

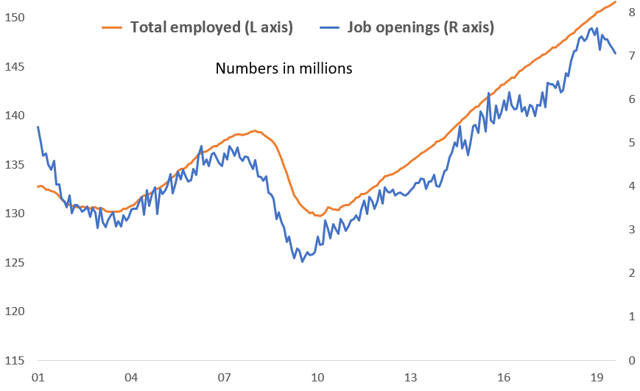

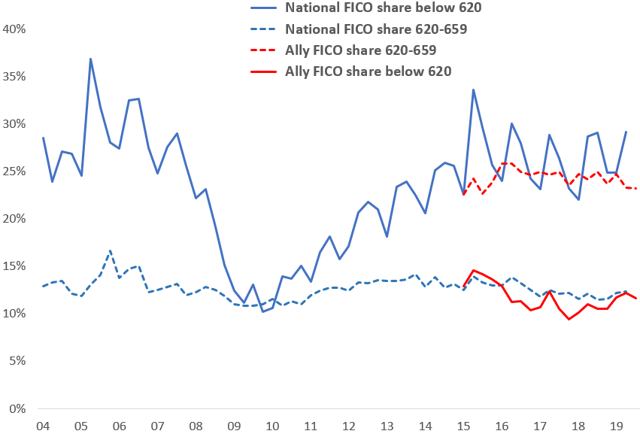

- Finally, and most importantly, reported lending standards are stable, as per this chart showing shares of risky car loans:

Sources: Ally financial reports and the Federal Reserve Bank of New York

Yes, Ally’s charge-off rate will rise, in part because it is making more used car loans today, which have both higher losses and higher loan yields. But unless the economy falls off a cliff, Ally should earn at least $3.00 a share.

Ally’s online bank continues to be a jewel

Growth remains strong. Year over year, retail deposits grew by 20%, and the number of customers by 23%. These growth rates obviously far exceed the banking industry’s low single-digit numbers, because Ally, without the overhead of a branch system, can offer higher than average interest rates to savers. And Ally says that 60% of its customers are millennials, who are in their early savings years.

This growth has allowed Ally to steadily pay down higher cost borrowed money. Just over the past year borrowed money declined by $10 billion, to $61 billion. Management said on its Q3 conference call that it feels confident enough in its marketing momentum that it is currently pricing at the bottom of the major online banks. As such, management expects its interest margin to widen next year.

Capital management remains very shareholder-friendly

A friend just told me a great saying (I paraphrase) – “Sales are good, earnings are better, cash is best.” Ally gets it. Banking is not a growth business. I saw it throughout my career on Wall Street – banking growth stories die. Ally’s earning assets, less investment securities, grew by only 3% over the past year. With a return on equity (ROE) of 12%, what did Ally do with the 9% of extra capital? It gave the cash back to investors. During Q3, paid $66 million in dividends and bought back $300 million of stock. That’s a $0.93 per share return to shareholders. Everything suggests that Ally will maintain this strategy going forward.

Fair value for the stock is at least 35% higher in my view

As I said above, only 4% of the S&P 500 has a lower P/E ratio than Ally’s 7.2 on 2020 expected EPS. My price target for Ally is $42. I get there in two ways:

Ally’s current book value is $37.70. Earning $1 a quarter, less its $0.17 per quarter dividend (which will be increased next year) gets to a $42 book by year-end 2020. With a 10% ROE, Ally should be worth at least book.

A 10 P/E is closer to the bank average, and at about the 20th percentile in the S&P 500. That seems more reasonable for a bank with two solid franchises.

Disclosure: I am/we are long ALLY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.