On top of the covid19 impacts on the economny, the Bank of England makes -0.50% emergency (unscheduled) rate cut ahead of UK budget.

Cable (GBP) traders seem to be watching anything but fundamentals as GBP/USD stuck in a range of 1.28 – 1.31 no matter what happens on Earth.

In the US, Monetary Policy must go to Zero plus QE must begin.

Subsidized credit guarantees must be provided.

The credit response must be to avoid a liquidity crisis.

Fiscal stimulus needs to be rolled out promptly before temporary impacts turn into prolonged, and possibly irreversable, damage to the global economy.

In 2008 we had contaigion from financial institutions and mortgage lenders.

In 2020 we have Corporate Debt, CLO Leveraged Loans will be downgraded to below investment grade which will force institutions to unload. Last year I named dozens of other reasons why a Recession (or worse) begins in early 2020.

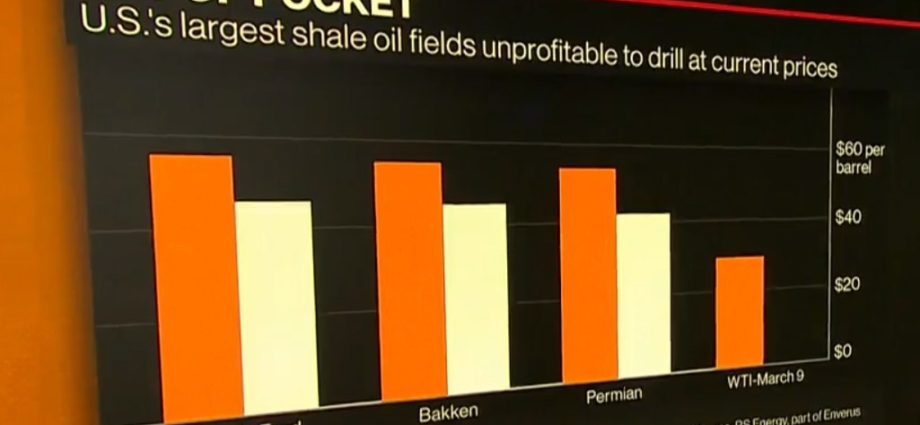

OPEC cuts non-OPEC supply estimates by 490 thousand barrels per day to 1.76 million per day.

A report shows that OPEC pumped 27.77 Million barrels per day in February.